Archive for March 2018

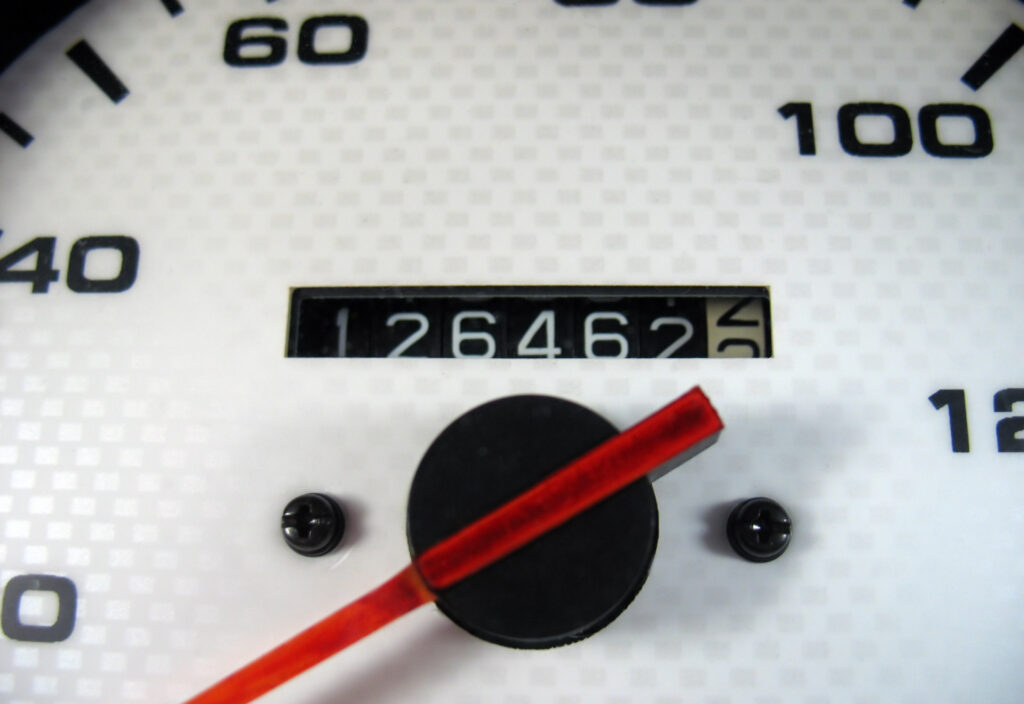

2018 – 02/27 – What’s your mileage deduction?

Miles driven for certain purposes can be tax deductible. But the rules are complex. And under the TCJA you may not be able to deduct some types of mileage expenses on your 2018 return that are deductible on your 2017 return.

Read More