Our Blog

Learn more with our advanced technology and experience team that will partner with you throughout the processes.

Tax credit for hiring from certain “target groups” can provide substantial tax savings

Many businesses hired in 2017, and more are planning to hire in 2018. If you’re among them and your hires include members of a “target group,” you may be eligible...

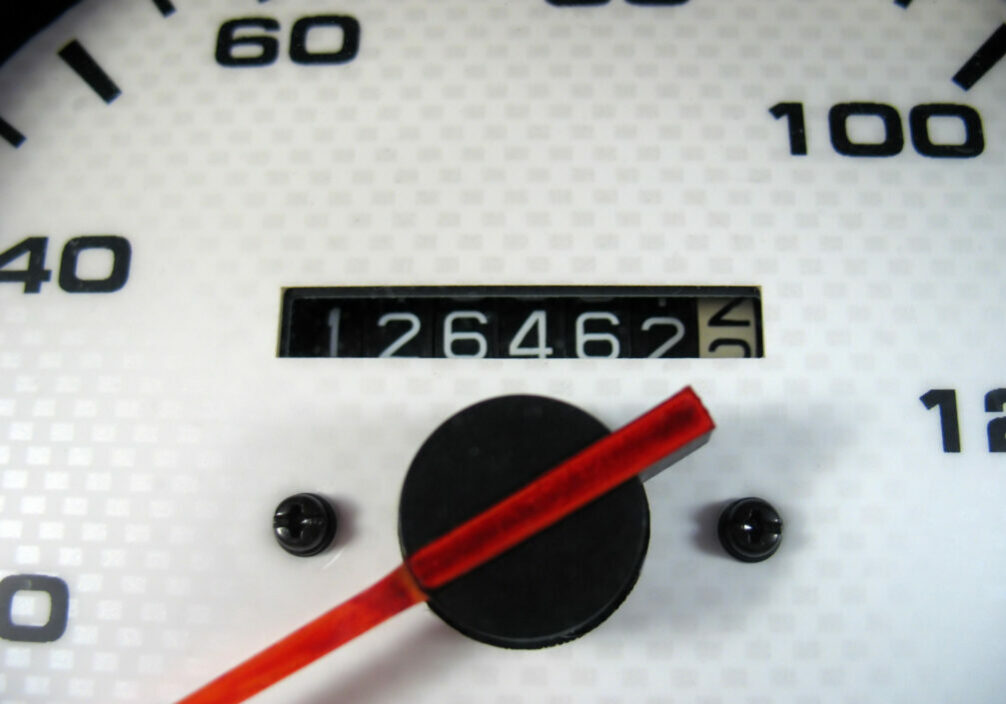

2018 – 02/27 – What’s your mileage deduction?

Miles driven for certain purposes can be tax deductible. But the rules are complex. And under the TCJA you may not be able to deduct some types of mileage expenses...

2018 – 01/26 Tax Cuts and Jobs Act

Do you know what the new credit for businesses under the Tax Cuts and Jobs Act offers to employers? The paid family and medical leave credit is now available to...

Which tax-advantaged health account should be part of your benefits package?

On October 12, an executive order was signed that, among other things, seeks to expand Health Reimbursement Arrangements (HRAs). HRAs are just one type of tax-advantaged account you can provide...

Getting around the $25 deduction limit for business gifts

At this time of year, it’s common for businesses to make thank-you gifts to customers, clients, employees and other business entities and associates. Unfortunately, the tax rules limit the deduction...

2017 might be your last chance to hire veterans and claim a tax credit

With Veterans Day on November 11, it’s an especially good time to think about the sacrifices veterans have made for us and how we can support them. One way businesses...

Should your business use per diem rates for travel reimbursement?

Updated travel per diem rates go into effect October 1. To simplify recordkeeping, they can be used for reimbursement of ordinary and normal business expenses incurred while employees travel away...